Are you an entrepreneur with a groundbreaking startup idea but limited funding options? Crowdfunding offers a viable solution, connecting you with a global pool of potential investors eager to support innovative ventures. In this comprehensive guide, [Using Crowdfunding to Fund Your Startup: A Guide for Entrepreneurs], we will delve into the intricacies of crowdfunding, empowering you with the knowledge and strategies to harness its potential for your startup’s success.

Key Takeaways:

- Crowdfunding involves raising funds from many people, usually online.

- Types of crowdfunding include equity-based, debt-based, and donation-based.

- Crowdfunding can help entrepreneurs get money without traditional loans.

- It can build a community of investors and test the market for a product or idea.

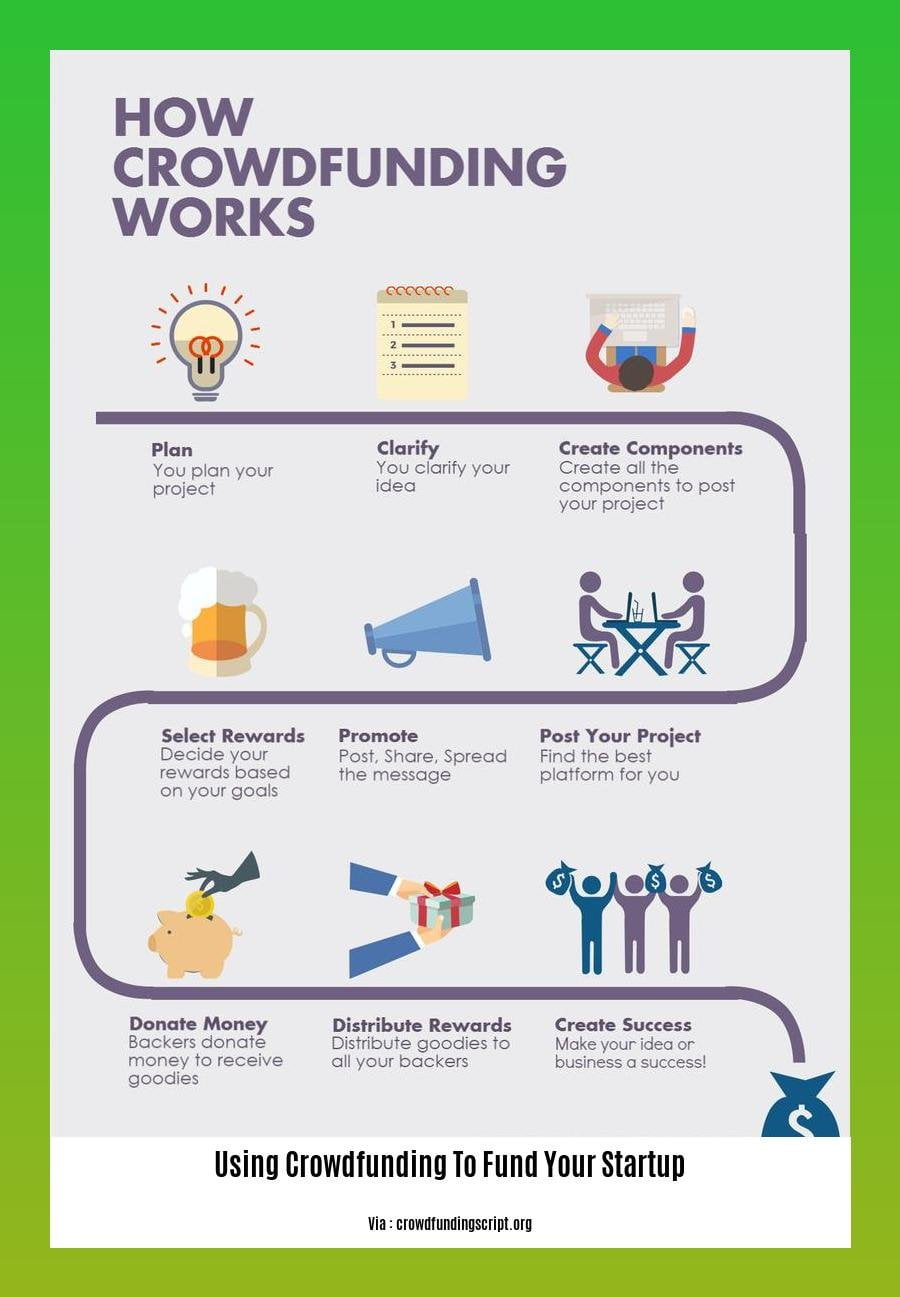

- Steps to crowdfunding include deciding if it’s right for your business, choosing a platform, planning your campaign, and using the funds wisely.

- Choose the best crowdfunding platform for your needs.

- Create a compelling campaign page and promote it effectively.

- Build relationships with potential investors.

- There are risks in crowdfunding, such as not reaching funding goals or losing control in equity-based campaigns.

- Follow regulations carefully.

Using Crowdfunding to Fund Your Startup

Crowdfunding has emerged as a powerful financing option for startups seeking alternative capital sources. Here’s a comprehensive guide to help entrepreneurs leverage this funding mechanism effectively:

Understanding Crowdfunding

Definition: Crowdfunding involves raising small amounts of money from a large number of individuals, typically through online platforms.

Types:

– Equity-based: Investors receive equity in your startup in exchange for their contributions.

– Debt-based: Investors receive interest payments and repayment of their principal.

– Donation-based: Investors provide financial support without expecting financial returns.

Benefits of Crowdfunding

- Access to capital without traditional financing.

- Building a community of investors who become brand advocates.

- Testing the market for your product or idea.

Step-by-Step Guide

1. Determine Eligibility: Consider your business model, funding requirements, and investor risk appetite.

2. Select a Platform: Choose a platform that aligns with your fundraising goals, fees, and target audience.

3. Plan Your Campaign: Craft a compelling campaign page, set funding goals, and establish a timeline.

4. Launch and Promote: Utilize social media, email marketing, and press outreach to promote your campaign.

5. Engage with Investors: Respond to inquiries, build relationships, and keep investors informed throughout the process.

Crowdfunding Platforms

| Platform | Focus | Fees |

|---|---|---|

| Kickstarter | Creative projects | All-or-nothing funding |

| Indiegogo | Flexible funding options | Platform fee |

| GoFundMe | Donation-based | Platform fee, processing fees |

Tips for Success

- Create a compelling campaign page that showcases your business, team, and value proposition.

- Promote your campaign effectively through multiple channels.

- Build relationships with potential investors by offering exclusive perks or updates.

Risks of Crowdfunding

- Potential failure to reach funding goals.

- Loss of control over your business in equity-based crowdfunding.

- Regulatory compliance issues and reporting requirements.

Embrace crowdfunding as a viable option to fund your startup and connect with a community of supporters. Follow these guidelines to increase your chances of success and achieve your fundraising aspirations.

raise funds for your next innovative project through effective crowdfunding campaigns for startup ideas. Check out our guide on successful crowdfunding for entrepreneurial ideas to find out how to get the most out of crowdfunding. We can help you turn your idea into reality. Crowdfund your startup concept today.

Leverage Social Media and Online Communities to Build Momentum

Key Takeaways:

- Crowdfunding is an effective way to grow your startup’s online presence.

- Social media is a powerful tool to amplify your campaign’s reach and create buzz.

- Engage with backers on a personal level on each platform.

- Community building is crucial for success, as it fosters relationships with your most passionate supporters.

- Regular progress updates are essential to keep backers engaged and excited.

Step-by-Step Guide:

- Plan Your Social Media Strategy: Determine which platforms your target audience is most active on, and tailor your content to each one.

- Build a Community: Create engaging content, respond to comments, and encourage followers to share their thoughts and experiences.

- Personalize Your Approach: Craft messages that resonate with each backer’s interests and motivations.

- Share Your Story: Connect with backers on an emotional level by sharing the inspiration and vision behind your project.

- Use Influencers to Amplify Your Reach: Partner with influencers in your industry who can share your campaign with their followers.

- Leverage Paid Ads: Consider using targeted social media ads to reach a wider audience and boost your campaign’s visibility.

- Track Your Results and Adjust: Monitor your progress on social media and make adjustments to your strategy as needed to maximize your impact.

Citation:

Utilize Crowdfunding Platforms Effectively to Reach a Wider Audience

Crowdfunding platforms are a powerful tool to reach a wider audience and raise capital for your startup. By effectively utilizing crowdfunding platforms, you can connect with potential investors, build a community of supporters, and amplify your brand visibility. Here are some strategies to help you succeed:

Cultivate a Strong Online Presence:

Establish a solid online presence across social media platforms and your website. Engage with potential backers, share updates about your project, and generate buzz around your campaign.

Craft a Compelling Campaign:

Develop a compelling campaign page that clearly outlines your project, its mission, and the value it offers. Use high-quality visuals, videos, and storytelling to showcase your idea and captivate backers.

Leverage Social Media:

Promote your crowdfunding campaign on social media channels. Utilize targeted advertising, influencer partnerships, and community engagement to reach a wider audience. Share engaging content that resonates with your target backers.

Engage with Backers:

Foster relationships with backers by providing regular updates, responding to inquiries promptly, and offering rewards and incentives. Transparent communication and genuine engagement build trust and keep backers invested in your project.

Monitor and Adapt:

Track campaign performance and adjust your strategy based on feedback and insights. Monitor social media, email metrics, and backer engagement to identify areas for improvement and optimize your campaign’s reach.

Key Takeaways:

- Establish a strong online presence to connect with potential backers.

- Craft a compelling campaign page that showcases your project’s value.

- Leverage social media to amplify your reach and engage with backers.

- Foster relationships with backers through transparent communication and genuine engagement.

- Monitor campaign performance and adapt your strategy based on feedback and insights.

Citation: The Crowdfunding Formula: Crowdfunding Social Media Strategy in 7 Steps

Monitor your campaign closely and adjust your strategy as needed

Tracking the progress of your crowdfunding campaign is vital to ensure it reaches its full potential. Here are some tips for monitoring and adjusting your strategy:

- Establish clear metrics: Decide on the key performance indicators (KPIs) you will track, such as the number of backers, funds raised, and engagement metrics.

- Use dashboards and analytics: Most crowdfunding platforms provide dashboards that track campaign performance. Utilize these to monitor progress in real-time.

- Analyze data regularly: Set aside time to regularly review the data and identify any trends or areas for improvement.

- Adjust your strategy: Based on the data, make adjustments to your campaign strategy. This may include revising the messaging, increasing marketing efforts, or offering additional rewards.

- Seek feedback: Engage with your backers and ask for feedback on the campaign. This can provide valuable insights for improving the strategy.

- Stay agile: Be prepared to make changes quickly as needed. The crowdfunding landscape is constantly evolving, so it’s important to adapt your strategy accordingly.

Key Takeaways:

- Monitoring campaign performance is crucial for success.

- Track key metrics using dashboards and analytics.

- Analyze data regularly and make adjustments as needed.

- Engage with backers for feedback.

- Stay agile and adapt your strategy to changing circumstances.

Source: 12 Key Strategies to a Successful Crowdfunding Campaign | Entrepreneur

FAQ

Q1: What are the benefits of using crowdfunding to fund my startup?

A1: Crowdfunding offers several benefits, including access to capital without traditional financing, building a community of investors, and testing the market for your product or idea.

Q2: What are the different types of crowdfunding?

A2: Common types of crowdfunding include equity-based, debt-based, and donation-based. Each type has its own advantages and considerations.

Q3: How do I select the right crowdfunding platform for my startup?

A3: Choosing a suitable platform is crucial. Consider factors such as platform fees, audience alignment, and industry expertise when making your decision.

Q4: What are some tips for creating a successful crowdfunding campaign?

A4: Craft a compelling campaign page, promote it effectively, and build relationships with potential investors. Stay transparent about fund allocation and offer incentives to backers.

Q5: What are potential risks associated with crowdfunding?

A5: Potential risks include failure to reach funding goals, loss of control to investors in equity-based crowdfunding, and regulatory compliance issues. Carefully consider these risks before embarking on a crowdfunding campaign.